State law requires that a county’s sales fall within 85-100% of market value. The state ensures compliance with this by controlling the ‘state factor’. The state factor is the third portion of the equation that determines tax values.

The formula for taxes is as follows:

Assessed Value x State Factor x Mill Levy = Taxes

Because the formula involves only multiplication an increase in any one of these numbers can increase the taxes if another of the numbers does not decrease in proportion. The state factor is determined by how close we are to ‘full market’. When we are closer to market our state factor is lower, when we are farther from market our state factor is higher. (See the examples of this in the table below)

|

County Sales Ratio |

State Factor |

|

100% |

85% |

|

95% |

89% |

|

90% |

94% |

|

85% |

100% |

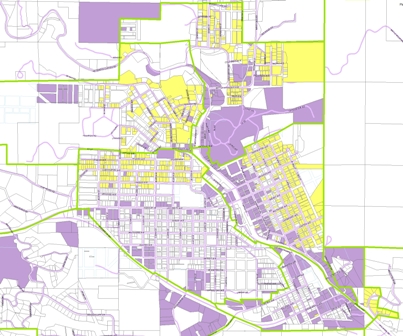

There are only two state factors given to each county, one for agricultural properties and one for non-agricultural. This means that one area of the county being under assessed can affect the tax value of everyone else. If for example we had two towns in our county; Town A was assessed at market value while Town B was under assessed. The properties in Town A should have a 85% factor for being at market value but because Town B is under assessed their sales bring the county’s sales ratio down. So instead of a 85% factor the state gives a 94% factor, this means that Town A properties will see a 9% increase in their taxes even though their assessed values and mill levies remained the same.