On March 11, 2026, at 1:30PM, we will conduct our annual Alert & Warning Functional Exercise.

This will be a Multi-County test (Fall River, Custer, Pennington, Meade) of Alert & Warning Systems to include:

• Wireless Emergency Alerts (WEA)

• NOAA Weather Radio

• Public Warning Messages (Subscription Based)

• Local Outdoor Alert Sirens – Angostura / Edgemont / Hot Springs & Oelrichs

• Emergency Alert System (EAS)

NOTICE OF ANNUAL ALERT & WARNING FUNCTIONAL EXERCISE

Job Opportunity: Administrative Assistant

Administrative Assistant, Registrar of Deeds

The Fall River County Register of Deeds is accepting applications for a full-time administrative assistant. Applicant must have the ability to work well with others, good organizational, computer & customer service skills, and the ability to lift up to 30 lbs. Ability to read and understand legal descriptions desired but training can be provided for applicants without this skill set.

Starting wage is $16.75-$17.75/hour (DOE) with full benefits: paid health & dental insurance; vacation, holiday and sick leave; and South Dakota Retirement. Position is 40 hours a week, hours are 8-5, Monday – Friday. Apply at the Register of Deed’s Office at 906 N River St. (605-745-5139). Position open until filled. [Full Job Description] See employment page for application.

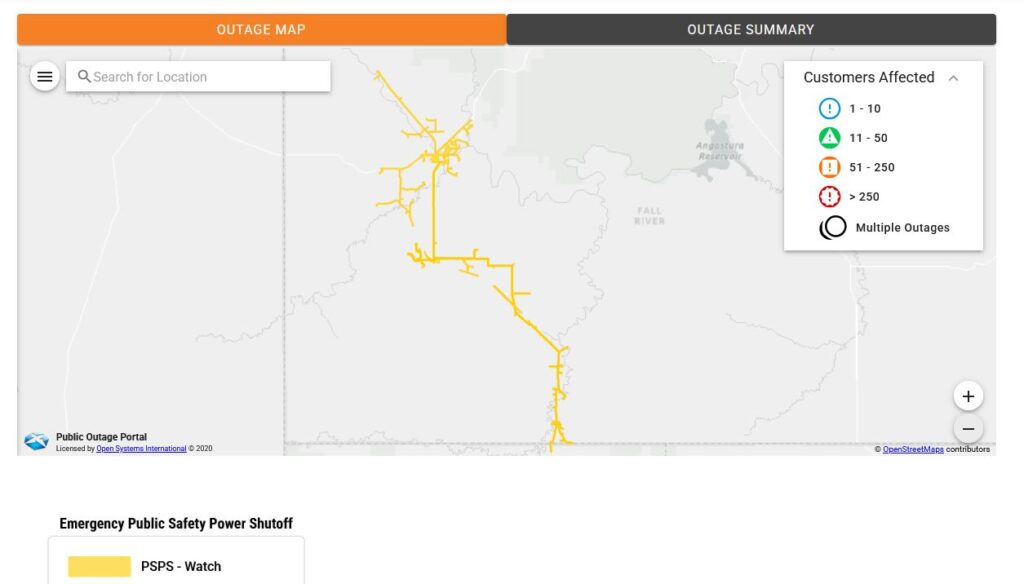

PSPS Warning – Edgemont & Hot Springs Areas

PSPS Warning Announced for Fall River County

Black Hills Energy has upgraded their Public Safety Power Shutoff (PSPS) Watch to a Warning for the Edgemont and Hot Springs Areas of Fall River County. If weather worsens the estimated shutoff would be on Tuesday, February 17th at 1pm. How to Prepare.

What is a PSPS?

A Public Safety Power Shutoff (PSPS) is a program implemented by Black Hills Energy as a last resort safety measure to prevent wildfires during high-risk weather conditions.

CodeRED Message

Due to an issue with the settings in CodeRED the alert message came out under the user name of Stacey Martin instead of the organization name of Fall River County. If you received a message from Stacey Martin that was the CodeRED message.

Black Hills Energy Outage Website

PSPS Watch – Edgemont Area

PSPS Watch Announced for Fall River County

Black Hills Energy has announced a Public Safety Power Shutoff (PSPS) Watch for the Edgemont Area of Fall River County. If weather worsens and this is upgraded to a PSPS Warning the Estimated shutoff would be on Tuesday, February 17th from 11am to 4pm. How to Prepare.

What is a PSPS?

A Public Safety Power Shutoff (PSPS) is a program implemented by Black Hills Energy as a last resort safety measure to prevent wildfires during high-risk weather conditions.

Black Hills Energy Outage Website

Fall River School Land Lease Auction

A school land lease auction will be held at the Fall River County Court House (3rd floor meeting room), Hot Springs SD, on March 31, 2026 at 1:30PM (MT).

A list of tracts available for lease may be obtained at the Fall River County Auditor’s Office or by contacting the Office of School & Public Lands, 500 E Capitol Avenue, Pierre, SD 57501-5070 or phone (605)773-3303. You may also visit the SPL website sdpubliclands.sd.gov.

Phone bidding will be allowed on a recorded conference line at 1-848-777-1212 with access code 18892020#. Disabled individuals needing assistance should contact the Office of School and Public Lands at least 48 hours in advance of the auction to make any necessary arrangements.

2026 Fall River Leases for Auction:

Lease: 20260043 (E1/2, Sec 11, Twp 11S, Rg 6E) 320 Acres, 88.763 AUMS

Min Per Acre: 7.94, Annual Rental: 2,540.80, Current Lessee: Dunbar Ranch LLC

Parcel Number: 43000-01106-111-00

Lease: 20260044 (W1/2, Sec 24, Twp 11S, Rg 6E) 320 Acres, 114.0 AUMS

Min Per Acre: 10.20, Annual Rental: 3,264.00, Current Lessee: Dunbar Ranch LLC

Parcel Number: 43000-01106-242-00

Lease: 20260045 (NW1/4, N1/2SW1/4, SE1/4, Sec 36, Twp 9S, Rg 8E) 400 Acres, 120.141 AUMS

Min Per Acre: 8.60, Annual Rental: 3,440.00, Current Lessee: Juniper Cattle Co LLC

Parcel Number: 03000-00908-362-00