Courthouse Hours

Monday – Friday

8:00 a.m. – 5:00 p.m.

Treasurer’s Office Vehicle License & Titles

8:00 a.m. – 4:00 p.m.

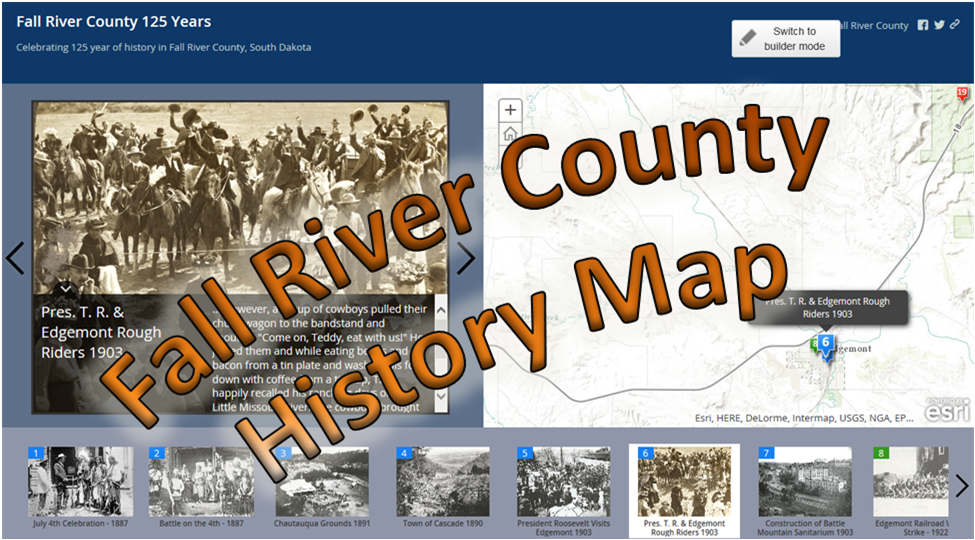

Records Available Online through the following programs:

Online map (assessment, tax and sale information), WebTax (tax, including delinquent tax information), Sales Search (property sales)

Additional records are available, for information on how to obtain these records please visit each office’s page under directory.

Can’t find what you’re looking for? Try the Contact tab above for a list of links by topic.

EMPLOYMENT OPPORTUNITY

February 5, 2026

The Fall River County Auditor’s Office is now accepting applications for an Payroll Administrative Assistant. Salary is $16.75 – $17.25/hr dependent on experience. See Employment tab for more information.

Confusion Regarding Owner Occupied Classification

February 5, 2026

FALL RIVER COUNTY, SD – January 28, 2026 – Following recent inquiries from property owners regarding property tax documentation and the application of Owner-Occupied status to multiple parcels. Owner Occupied classification can be applied to a person’s principal residence and contiguous land. There are also special circumstances that allow a person to claim owner occupied status […]

Courthouse Closed – Martin Luther King, Jr. Day

January 15, 2026

The Fall River County Courthouse will be closed Monday, January 19th in observance of Martin Luther King Jr. Day. Regular hours will resume Tuesday, January 20th.

Potential for Emergency Public Safety Power Shutoff this week

January 14, 2026

Potential Fire Danger this week Black Hills Energy has announced that there is potential for a PSPS this week. Near-critical fire weather conditions are expected Thursday and Friday, January 15th and 16th, across the Wyoming and South Dakota plains given the strong northwest winds and dry conditions. How to Prepare. What is a PSPS? A […]