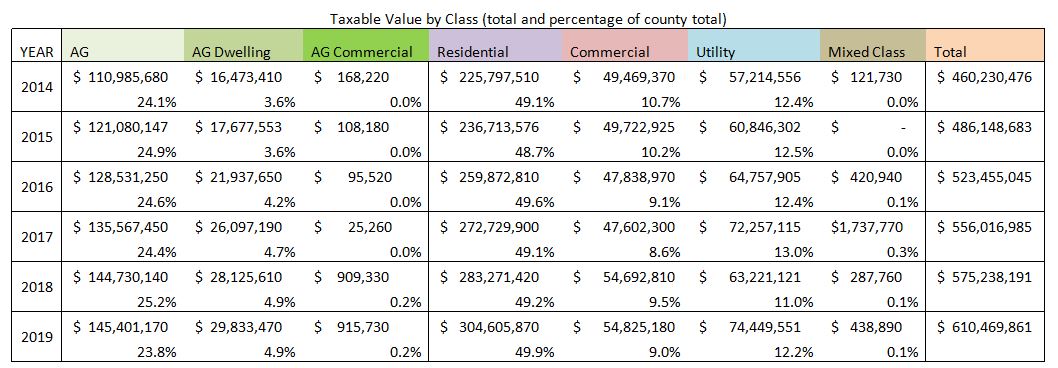

Below is a table of the taxable value by different class types from 2014 to 2019. (Year given is the year taxes were due; this would be the year after the assessment of that property.) Years 2015 – 2017 show the effect of the residential reassessment throughout Fall River County. 2018 shows the result of the commercial reassessment. Years 2015 through 2018 were also years that the State of South Dakota was increases the agricultural land values at rates of 10-25% a year. There was no reassessment in Fall River County in 2019 so increases to classes in this year are due to growth (new buildings), area increases due to sales, or State Ag productivity increases (Ag land).

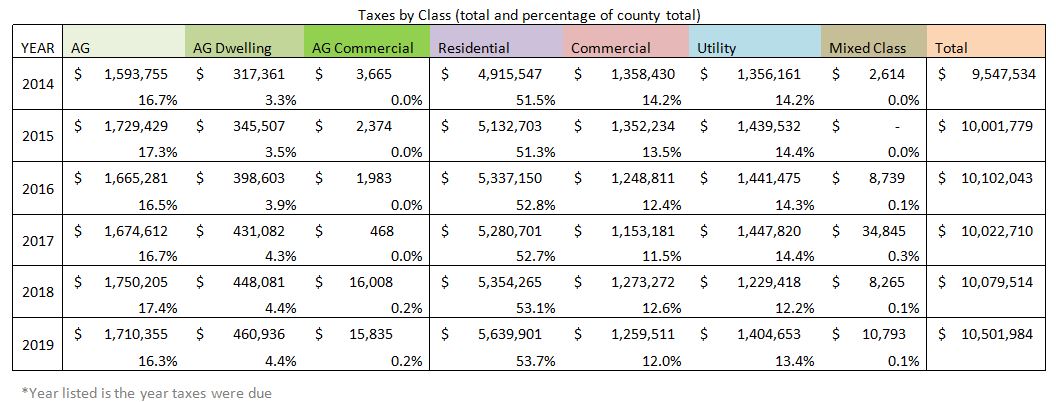

Below is a table showing taxes by different class types for the same range of years. The percentage of taxes paid by each group is not the same as the percentage of taxable value for that group. The reason for this is that different classes pay taxes at different mill levies. For example the agricultural mill levy is lower than the non-agricultural mill levy so even if the Ag land value and the Commercial values were the same the commercial properties would still pay more in taxes.

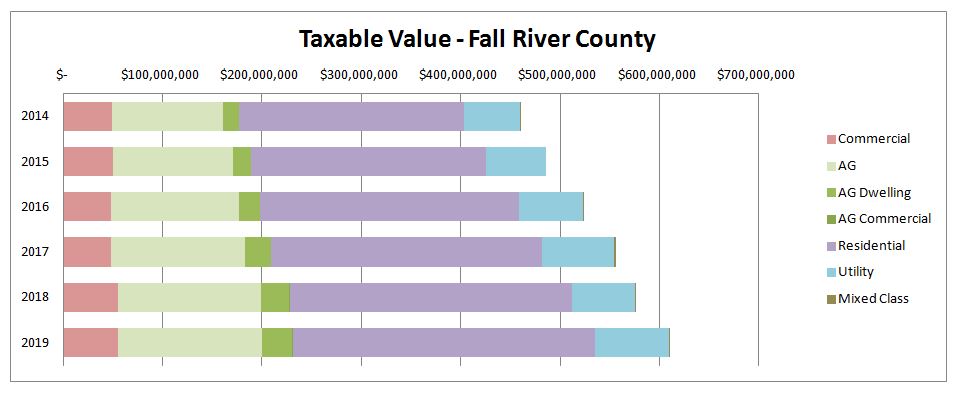

Below are two charts showing the data from the above tables. As taxable value increases on the first chart, taxes remain the same on the second. This is due to the mill levy decreasing along with the assessment increases.

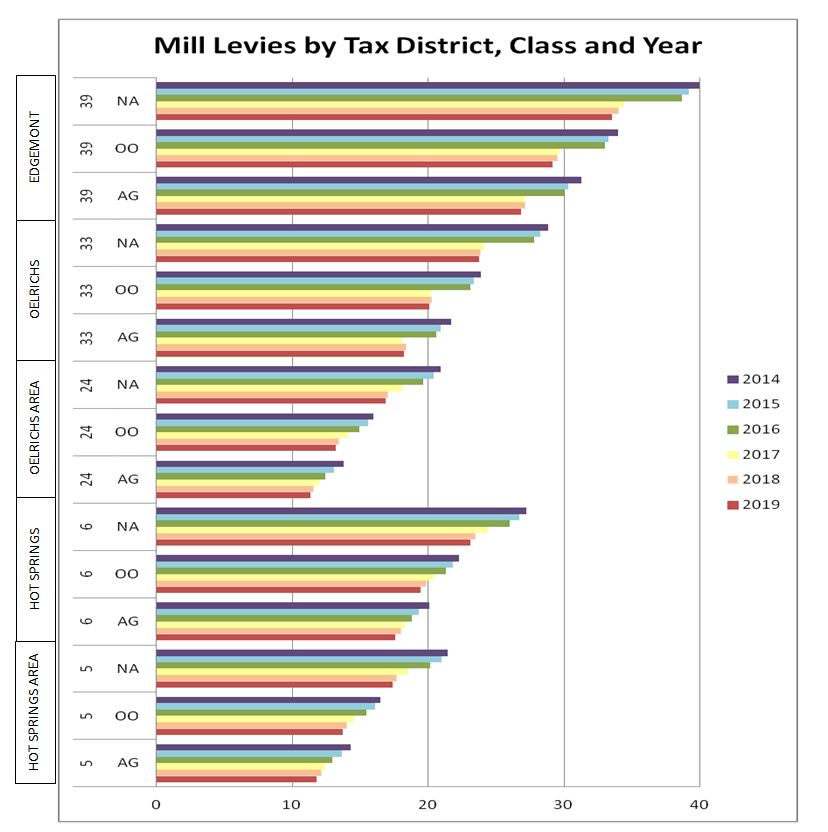

Mill levies have been decreasing every year since the reassessment began. County, city, township, and other mill levies are budget driven and will decrease as assessment value increase so long as budgets remain the same. School mill levies are set by the State and are statewide. During the agricultural land increases in the years prior to 2019 the State was lowering those school mill levies. Below is a chart showing the mill levies for a sample of the taxing districts.

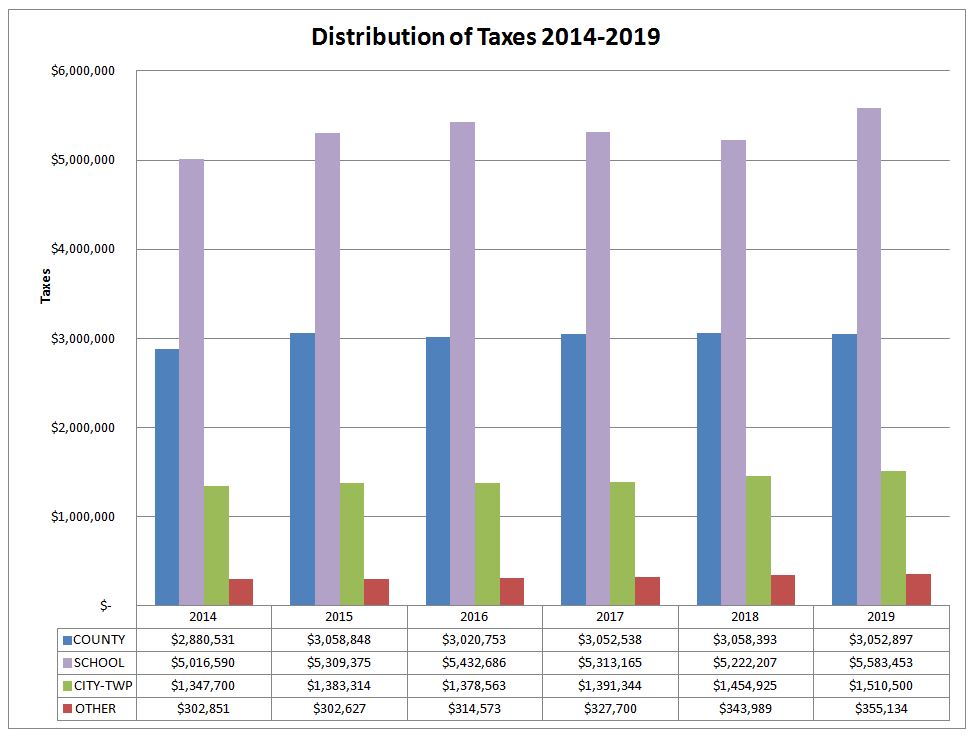

The first group of charts show who taxes are being collected from; this last chart shows where those taxes are going. The ‘other’ category includes items such as: road districts, fire departments (rural), and library.