The deadline for the Ag soil adjustment application is almost here. Forms must be filed before September 1st, 2025 for the assessment notice you will receive in March 2026 (taxes for January 2027).

How can I know if my property has ‘crop’ soils?

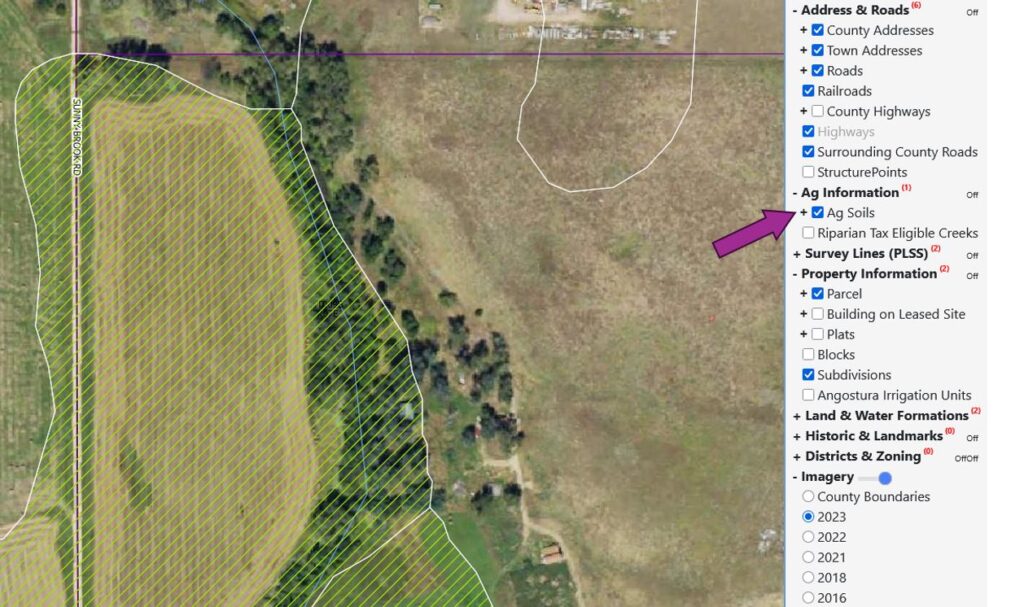

There is a layer on the online map that will show you the location of any ‘crop’ soils on your property. Go to the online map. Click on ‘Layer’ on the upper right. Under the heading ‘Ag Information’ turn on the ‘Ag Soils’ layer. Crop soils will show up with a green hash pattern.

What can I get adjusted?

There needs to be a reason that you CANNOT crop the soil. The State does not allow for adjustments simply because you are not cropping.

Commons adjustment reasons in Fall River County include; forested creek gullies, lack of access for equipment, shelterbelts, excessive stoniness or boulders, and excessive exposed hardpan. For a full list of the factors that can be adjusted for see South Dakota Codified Law 10-6-131. Remember that you must provide some type of documentation to support the adjustments you are requesting. This is easy enough when you have surface obstructions and can take photos of trees or rocks. Climate and soils survey statistics can be harder for owners to provide documentation for.

How much money will this save me?

It varies from soil type to soil type. Generally the savings is $2-$5 in taxes per acre adjusted. So if you only have 3-5 acres it may not be worth your time to apply. However, the more acres the more it can be worth your time.

Adjustments remain on the property until the owner sells unless the owner physically changes something about the property that removes the reason for the adjustment.

You can file the form online. Or call the DOE office for assistance at 605-745-5136 before August 31st.