FALL RIVER COUNTY, SD – January 28, 2026 – Following recent inquiries from property owners regarding property tax documentation and the application of Owner-Occupied status to multiple parcels.

Owner Occupied classification can be applied to a person’s principal residence and contiguous land. There are also special circumstances that allow a person to claim owner occupied status on properties where they are housing their parents or an adult child with a disability (SDCL 10-13-39 thru 10-13-39.3).

Recent confusion arose after a generic description, originally intended for internal use within the county’s assessment system, was mistakenly displayed on the public-facing website. The Department of Equalization is actively updating the website to include precise language and prevent similar misunderstandings in the future.

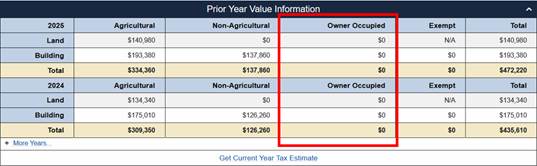

“We want to assure homeowners that the Owner-Occupied reduction is correctly listed and applied in our system, specifically within the designated ‘Owner Occupied’ value column on the county website,” said Everett Dossey, Director of Equalization. “We apologize for any confusion caused by the internal, generic language on the public-facing site and are working quickly to fix it.”

Owner-Occupied classification is constantly changing as people move, buy, sell, and pass away. Due to the dynamic nature of this classification, there is a continual audit to check that owner occupied classification is being correctly applied. If you see something in our system that seems to be in error, please contact the Director of Equalization so that it can be investigated.

For further information or to review specific property tax records, please contact the Director of Equalization office at 605-745-5136 or visit the official website at https://fallriver.southdakotadirectors.com/.