The Fall River County Courthouse and South Annex Offices will have a two hour late start this morning, Friday, March 7th. Due to the winter storm. Offices will open at 10am.

Green Acres Fire

Update 3/5/25: Great Plains Dispatch morning report listed fire as 345 acres and 75% contained. There are four engines still assigned to this fire (3 federal, 1 local).

Update 3/3/25: As of this morning the fire was listed on Great Plains Dispatch as 75% contained. Acreage has not changed from the 340 acres previously announced. No structures have been reported lost. Federal, State, and local crews are still working.

Update 10:38AM 3/2/2025 from SD Department of Public Safety: “The Green Acres Fire 3 miles SW of Hot Springs is now estimated at 340 acres in size. Substantial progress was made on containment lines, but it’s not fully contained yet.

Update 7:23 PM: All evacuation have been lifted. Fire crews will still be working through the night to monitor the fire. Please be considerate and stay out of their way. We thank you for your help in this matter.

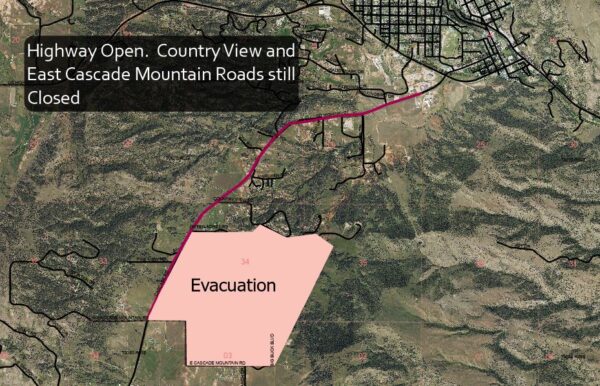

Update 5:55 PM: Cascade Road (SD Highway 71) has reopened for local traffic. Roads within the evacuation area (Country View and East Cascade Mountain Roads) are still closed. The Green Acres Fire has been held to 150 acres with no structures lost at this time.

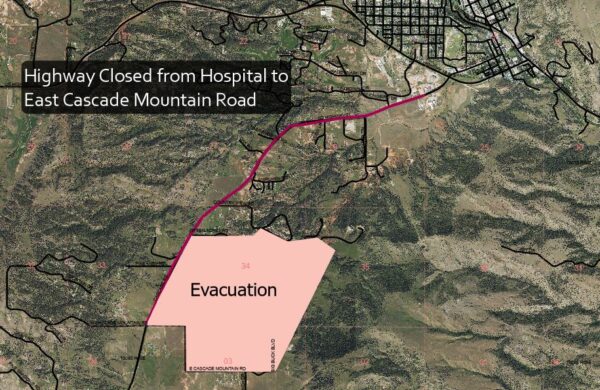

Update 3:30PM: Evacuation area has been expanded to all properties between Country View Road and East Cascade Mountain Road. Cascade Road (SD Highway 71) is being closed to all unnecessary travel from the Hospital to East Cascade Mountain Road. Please avoid the area.

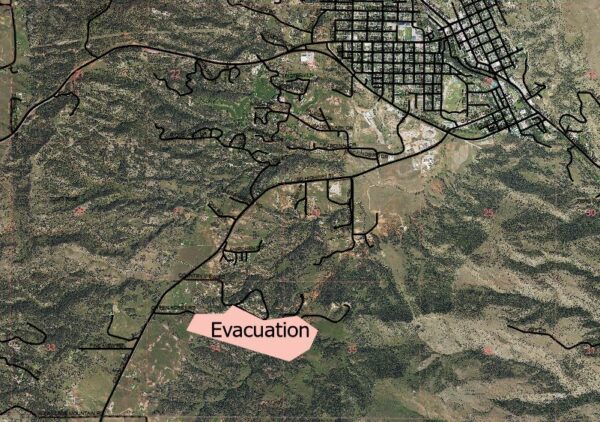

Original Post: About 12:10 pm a wildfire was reported along Cascade Road (SD Highway 71) south of Green Acres Road. The fire is spreading to the northeast. Evacuation has begun for homes south of Country View Road. Owner in Country View Subdivision and Green Acre Estates should remain attentive to the fire situation and be prepare to evacuate.

The Hot Springs Fire Department, Minnekahta VFD, Cascade VFD, Ardmore VFD, State Wildland Fire, and the VA are on scene.

Courthouse Closed – Presidents Day

The Fall River County Courthouse will be closed Monday, February 17th, 2025 in observance of Presidents Day. Regular hours will resume Tuesday, February 18th, 2025

TEMPORARY OFFICE CLOSURE

CLOSURE NOTICE

THE TREASURER’S OFFICE

WILL BE CLOSED ON 2/14/2025 FOR A

STATEWIDE SOFTWARE UPDATE.

NORMAL HOURS WILL RESUME ON 2/18/2025.

THANK YOU FOR YOUR UNDERSTANDING!

Winter Weather Preparedness

As the winter season approaches, the National Weather Service encourages people to prepare for extreme winter conditions by taking the following steps:

– Check your vehicle’s battery, antifreeze, wipers and windshield washer, ignition, thermostat, and tires.

– Even if you do not make long trips, put a winter survival kit in each vehicle–you may need it if your car breaks down or you have an accident. It should contain a windshield scraper, jumper cables, tool kit, tow chain or rope, tire chains, bag of sand or cat litter, shovel, flashlight with extra batteries, first aid kit, warm boots, coat, hat, gloves, and a blanket. For longer trips; add extra clothes, sleeping bags, a portable radio, high-calorie nonperishable food, matches and candles, and large coffee cans for sanitary purposes or burning candles.

– Keep an adequate supply of fuel for your home or get an alternative heating source. Learn how to operate stoves, fireplaces, and space heaters safely and have proper ventilation to use them.

– Add insulation to your home; caulk and weather-strip doors and window sills; install storm windows or cover windows with plastic.

– Stock emergency supplies at home; such as flashlights, candles, matches, a battery-powered radio, extra batteries, and a first-aid kit.

– Monitor Internet web sites, NOAA Weather Radio, or local radio or television stations for forecasts and information about impending storms.

Know the terms used to describe hazardous winter weather and what actions to take for each situation.

A WINTER STORM WATCH means a dangerous winter storm is possible. WATCHES are issued to give people time to prepare for hazardous conditions before they develop. When a WATCH is in effect:

– Postpone trips or take a different route. Put a survival kit in your vehicle. Tell someone your schedule and route; call them when you arrive at your destination. If possible, travel in daylight and use major highways. Keep your fuel tank as full as possible to avoid ice in the tank and lines.

– At home; have high energy food or food that requires no cooking, one gallon of water per day for each person, and enough fuel for the duration of the storm. Don’t forget special items for your family such as prescription medicine, baby formula and diapers, and pet food!

– Consider having elderly, ill, or oxygen-dependent family, friends, and neighbors who live in rural areas stay someplace where heat and electric power are available.

WINTER STORM AND BLIZZARD WARNINGS mean a dangerous storm will occur.

– Do not travel. You are safer to stay where you are rather than risk getting stranded in a ditch.

– If you have no heat, close off unneeded rooms and wear extra clothes.

– Do not operate power generators indoors.

WIND CHILL WARNINGS AND ADVISORIES stress the increased risk of frostbite and hypothermia during cold and windy conditions.

– Stay inside as much as possible. If you go outdoors; wear several layers of loose-fitting, lightweight clothing and water-repellent outer garments. Cover all parts of your body; especially your head, face, and hands.

– When working outdoors, do not overexert yourself. Remove damp clothing as soon as possible to avoid becoming chilled.

Additional information on preparing for winter weather is available from your county emergency management office, American Red Cross, or National Weather Service at http://www.nws.noaa.gov/om/winter/index.shtml