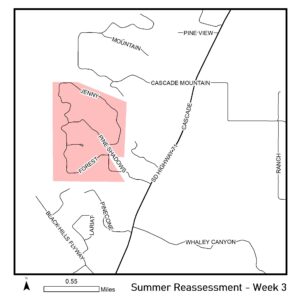

For the week of July 15th the assessors will be continuing in Pine Shadows Subdivision.

Why my property? Fall River County implemented a 7-year rotation after the county-wide reassessment was completed. This ensures that every property is physically visited by an assessor at least once every 7 years. Your neighborhood is one of those scheduled to be visited this year.

What is reassessment? Reassessment is when the assessor comes to your property to check for any changes, whether improvements or deterioration of buildings. They will take new exterior photos and walk around the outside of your buildings. If you are present they may ask you questions about the interior of the building, if you are not present they will leave a doorhanger with contact information so they can converse with you about the property later via phone or email.

When exactly will you be at my property? We will be posting on our website which streets are being assessed each week, you can check there for updates.

Why don’t you make appointments? The short answer: it takes less time for our assessors to start at one end of the street and do each property than it does to jump from property to property based on appointments. As we are paid by tax dollars, we consider it most important that we perform this job in a time efficient manner. The door-to-door method has proven to be three times more efficient than making appointments.

Who is coming? Our assessors will have county identification badges and will be driving a county vehicle. If you are suspicious that someone is falsely claiming to be an assessor, please call our office at 605-745-5136 or Fall River County Dispatch at 605-745-5155.

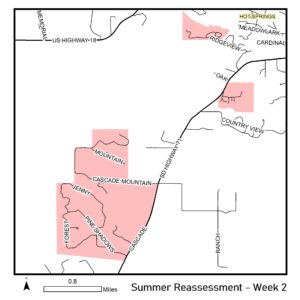

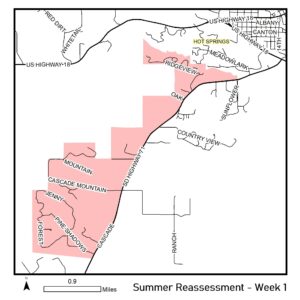

See Summer Reassessment page for maps of Summer 2024 reassessment area.