The Treasurer’s Office is hiring an administrative assistant. See the Employment Tab for full job announcement.

February 21, 2026

906 N. River Street, Hot Springs, SD 57747

The Treasurer’s Office is hiring an administrative assistant. See the Employment Tab for full job announcement.

The county burn ban is lifted. What does that mean for fireworks? It is important to know that there are many burn bans issued by overlapping jurisdictions. State and Federal entities have burn bans and firework restrictions on various areas of Fall River County. Even with the county issued burn ban revoked, over 60% of Fall River County is still prohibited from open fires and fireworks.

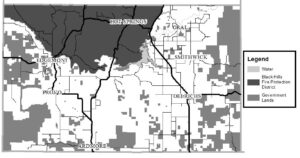

State law 34-37-11 prohibits fireworks and pyrotechnics within 300 feet of the Black Hills Protection District. The portion of the district lying in Fall River County includes all lands that lay north of the Cheyenne River AND west of SD Highway 79. Fires in this area are allowed only with a permit.

The same State law prohibits fireworks on land within any national forest, national park, state forest, or on land owned or leased by the Department of Game, Fish and Parks. A violation of this law is a Class 2 misdemeanor. A second or subsequent violation of this section is a Class 1 misdemeanor.

This restriction of fires and fireworks on public lands is reinforced by restrictions issued by the Federal and State entities managing them. The Black Hills National Forest, Buffalo Gap National Grasslands, GF&P, and other entities have permanent restrictions on fireworks. Fireworks are not allowed, ever, regardless of holidays or weather conditions. Fires are allowed only in designated recreation areas.

The map below shows the areas in white that do not have a burn ban.

So where can you shoot fireworks? On private land south of the Cheyenne River OR east of SD Highway 79 with the landowner’s permission. The municipalities of Hot Springs and Edgemont also allow some fireworks depending on weather conditions. See the city websites or county website fireworks post for details. Be aware that failure to control or report dangerous fire is a Class 1 Misdemeanor while Reckless burning or exploding is a Class 4 felony. These charges can be applied when fire or explosions are endangering life or a substantial amount of property. You may also be held financially responsible for any fire suppression costs if a fire becomes out of control.

So, if you intend to enjoy this 4th of July with fireworks please take some precautions. Don’t wait for a fire to start to find your garden hose; have a bucket of water, a garden hose or fire extinguisher ready. Having a couple shovels around to throw dirt on the start of a grass fire can also be effective until it can be doused. Trim the vegetation in areas where you are shooting fireworks and wet the area before and after. Clean out your gutters and clear away dry yard debris. Don’t shoot off fireworks near a house or other structure.

Regarding fireworks, please call dispatch only if you need the fire department or are willing to sign a complaint for charges against an individual you believe to be in violation of the law or city ordinance.

The 4th of July is almost here, so where can you shoot Fireworks in Fall River County?

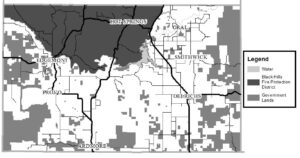

In Fall River County (outside of city limits) fireworks are permitted on PRIVATE land OUTSIDE of the Black Hills Fire Protection District. That is land SOUTH of the Cheyenne River and EAST of SD Highway 79. The discharge of fireworks is permitted from June 27 through July 9, 2023 per State Law 34-37-16.1 . South Dakota Codified Law 34-37-11 prohibits the use of fireworks within the Black Hills Forest Fire Protection District, it also prohibits the use of fireworks on public lands such as national forests, national parks, land managed by the Game Fish & Parks, etc. The Black Hills National Forest and Buffalo Gap National Grasslands also have their own published restrictions on fireworks.

The areas marked in white on the map below indicate areas where fireworks are not banned.

Game, Fish, and Parks does NOT allow fireworks on their properties, ever, regardless of holiday or weather condition per South Dakota Codified Law 34-37-11 . This includes the Angostura Recreation Area as well as Shep’s Canyon Recreation Area.

July 4th from 9AM – 11Pm Cones, Fountains and Novelty devices permitted as long as the fire danger for the Southern Hills is not HIGH, VERY HIGH or EXTREME (See the City of Hot Springs ordinance 93.06 for full set of rules)

No consumer fireworks that explode or provide a “report” such as but not limited to firecrackers, aerial mortars, bottle rockets, skyrockets, etc. may be discharged.

Fireworks are permitted when the fire danger for the Prairie is LOW or MODERATE. From July 1st through the 5th, 9AM to 10PM (until midnight on the 4th).

Fireworks are NOT allowed within the Edgemont City Park without prior approval of the Edgemont Common Council. Fireworks are NOT allowed on any property marked as No Trespassing or with signs prohibiting the discharge of fireworks. All fireworks discharge must be cleaned up and properly disposed of within 24 hours. City Ordinance 2016-11-1

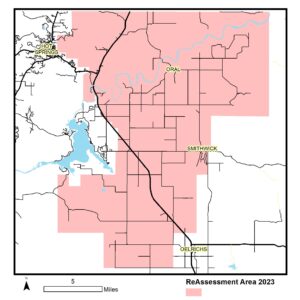

The assessors have finished their reassessment routes in Fall River County for the summer of 2023 as of June 2nd, 2023. They will now be working on finishing call backs for those who have contacted our office and building the data collected in the field into our system.

Their office will also be completing a reassessment in Oglala Lakota County this summer. The assessors will be back in the field working on that county starting June 19th. If you wish to speak with an assessor it is better to call for an appointment to ensure that they will be in the office when you come.

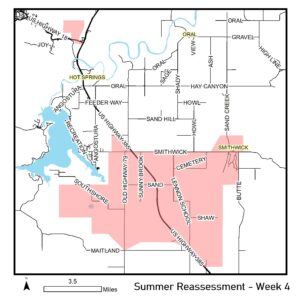

Week of May 30th: Assessors will be wrapping up a few areas around Maverick Junction. They will then begin to work in the Town of Smithwick and from there they will be heading west and south.

See Summer Reassessment 2023 page for further details and frequently asked questions.

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.

Copyright © 2026 on Genesis Framework · WordPress · Log in