I got my assessment notice in the mail. What am I supposed to look for?

There are a few things you need to check on your assessment notice.

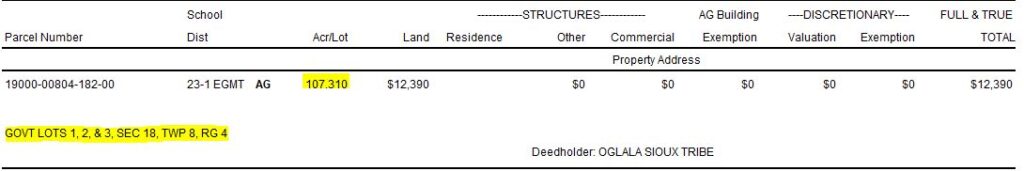

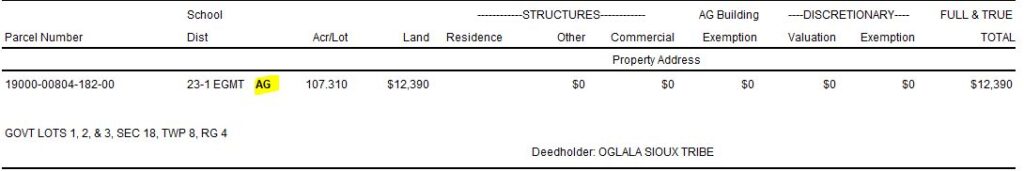

First, if you had any changes to the property you owned between November 1st, 2021 and November 1st, 2022 such as buying, selling, or platting land check to make sure that the legal description and the number of acres match what you think you should own.

Second, check that the property is classified correctly. There are three classifications:

AG – agricultural land and buildings

OO – owner occupied, this is property that the owner claims as their primary residence, you can only claim one property in the country as your primary residence

NA – non-agricultural, this refers to all other property including commercial, industrial, vacation homes, rentals, etc

AG and OO receive lower school mill levies than NA so be sure you have that classification if you qualify.

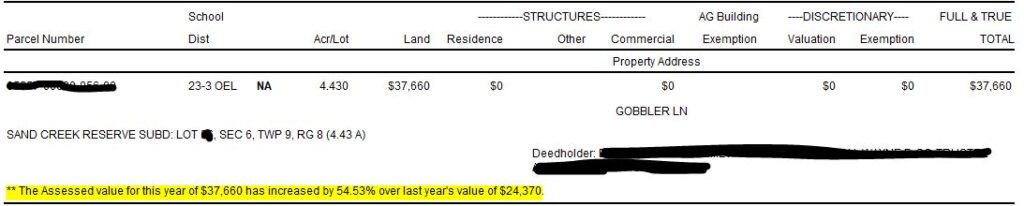

Third, (but what you probably did first) check the value of the property. Property is to be valued at market value. We aim for a range of 85% – 100% of market value. That means if your home would sell for $100,000 on the market it’s assessed value should be between $85,000 and $100,000 dollars. This is a requirement of State law.

How do I know if my property is at market value?

If you haven’t been aware of the market go look at one of the online real estate websites and see what properties are selling for in your area. You may be surprised. If you believe that your property is valued for more than it would sell on the open market then you need to contact the Director of Equalization’s office. They will put you in contact with an assessor who will review the property with you. They will check to ensure that the data we have for the property is correct and will provide you with sales of properties that are comparable to your own to show it is at market value. If, after seeing the comparable sales you still believe your property to be over valued you can appeal the value. (See deadline for appeals)

If you own vacant land we have posted vacant land sales for some subdivisions and areas of Hot Springs and Edgemont on the county website. When comparing assessed values to sales for vacant land be sure to find properties that are similar in size to your own. Per acre values generally reduce the more acres that are involved in the sale.

How do I know if my property increased?

If your property increased more than 20% it will state that directly on your assessment notice along with the value from last year. If your change was less than 20% you have a couple options. First, find your assessment notice from last year. Second, look up your property using the online county map. Third, contact the Director of Equalization’s office, 605-745-5136 or [email protected]. DO NOT compare the assessment value to the taxable value on the tax notice you just received. The taxable value is only a percentage of the assessment value from last year, meaning it is lower than the assessment value you received.

My value went up. Does this mean my taxes will go up as well?

The simple answer is: there is not a simple answer. The tax you pay depend not just on your value and your increase but on everyone else’s value and increase. If you increase 30% but everyone else increases 50% then chances are that your taxes will actually decrease. We have published maps showing the median increase in different neighborhoods for residential homes so you can compare your percentage to your neighborhood percentage.

There are other articles on our website with more details as to how assessed values, taxes and mill levies affect each other. Any potential increase in taxes will not be as high as the increase in assessed value.

How to look up my property online?

Go to the online county map. Select the ‘Real Estate Search’ button. Type in your parcel number or name (enter or click ‘display results). The second header down contains prior year value information.

Return to 2026 Assessment Information Page