Courthouse Hours

Monday – Friday

8:00 a.m. – 5:00 p.m.

Treasurer’s Office Vehicle License & Titles

8:00 a.m. – 4:00 p.m.

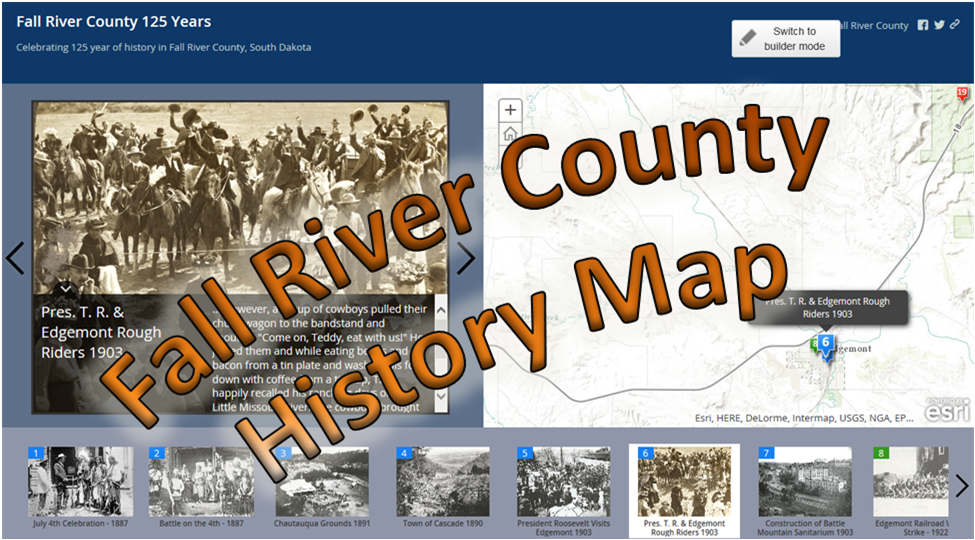

Records Available Online through the following programs:

Online map (assessment, tax and sale information), WebTax (tax, including delinquent tax information), Sales Search (property sales)

Additional records are available, for information on how to obtain these records please visit each office’s page under directory.

Can’t find what you’re looking for? Try the Contact tab above for a list of links by topic.

Ag Soil Adjustment Deadline

July 11, 2025

The deadline for the Ag soil adjustment application is almost here. Forms must be filed before September 1st, 2025 for the assessment notice you will receive in March 2026 (taxes for January 2027). How can I know if my property has ‘crop’ soils? There is a layer on the online map that will show you […]

Summer Reassessment – Week 9

July 11, 2025

Week of July 14th: Our assessment teams will continue working in the same area of the City of Edgemont this week; properties north of C Street and west of 8th Avenue. Why my property? Fall River County implemented a 7-year rotation after the county-wide reassessment was completed. This ensures that every property is physically visited […]

Summer Reassessment – Week 8

July 7, 2025

Week of July 7th: Our assessment teams will be working in the City of Edgemont this week on properties north of C Street and west of 8th Avenue. Why my property? Fall River County implemented a 7-year rotation after the county-wide reassessment was completed. This ensures that every property is physically visited by an assessor […]

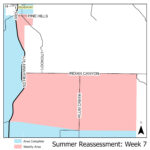

Summer Reassessment – Week 7

June 30, 2025

Week of June 30th: If the thunderstorms will cooperate we will attempt to finish the out-of-town properties this week on Plum Creek Rd, south of Indian Canyon Road, Pine Hills Road, and Lookout Road. Why my property? Fall River County implemented a 7-year rotation after the county-wide reassessment was completed. This ensures that every property […]