The Fall River County Courthouse will be closed Monday, February 16th, in observance of President’s Day. Regular office hours will resume Tuesday, February 17th.

Fall River School Land Lease Auction

A school land lease auction will be held at the Fall River County Court House (3rd floor meeting room), Hot Springs SD, on March 31, 2026 at 1:30PM (MT).

A list of tracts available for lease may be obtained at the Fall River County Auditor’s Office or by contacting the Office of School & Public Lands, 500 E Capitol Avenue, Pierre, SD 57501-5070 or phone (605)773-3303. You may also visit the SPL website sdpubliclands.sd.gov.

Phone bidding will be allowed on a recorded conference line at 1-848-777-1212 with access code 18892020#. Disabled individuals needing assistance should contact the Office of School and Public Lands at least 48 hours in advance of the auction to make any necessary arrangements.

2026 Fall River Leases for Auction:

Lease: 20260043 (E1/2, Sec 11, Twp 11S, Rg 6E) 320 Acres, 88.763 AUMS

Min Per Acre: 7.94, Annual Rental: 2,540.80, Current Lessee: Dunbar Ranch LLC

Parcel Number: 43000-01106-111-00

Lease: 20260044 (W1/2, Sec 24, Twp 11S, Rg 6E) 320 Acres, 114.0 AUMS

Min Per Acre: 10.20, Annual Rental: 3,264.00, Current Lessee: Dunbar Ranch LLC

Parcel Number: 43000-01106-242-00

Lease: 20260045 (NW1/4, N1/2SW1/4, SE1/4, Sec 36, Twp 9S, Rg 8E) 400 Acres, 120.141 AUMS

Min Per Acre: 8.60, Annual Rental: 3,440.00, Current Lessee: Juniper Cattle Co LLC

Parcel Number: 03000-00908-362-00

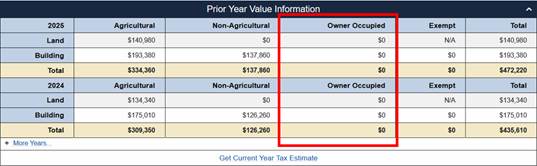

Confusion Regarding Owner Occupied Classification

FALL RIVER COUNTY, SD – January 28, 2026 – Following recent inquiries from property owners regarding property tax documentation and the application of Owner-Occupied status to multiple parcels.

Owner Occupied classification can be applied to a person’s principal residence and contiguous land. There are also special circumstances that allow a person to claim owner occupied status on properties where they are housing their parents or an adult child with a disability (SDCL 10-13-39 thru 10-13-39.3).

Recent confusion arose after a generic description, originally intended for internal use within the county’s assessment system, was mistakenly displayed on the public-facing website. The Department of Equalization is actively updating the website to include precise language and prevent similar misunderstandings in the future.

“We want to assure homeowners that the Owner-Occupied reduction is correctly listed and applied in our system, specifically within the designated ‘Owner Occupied’ value column on the county website,” said Everett Dossey, Director of Equalization. “We apologize for any confusion caused by the internal, generic language on the public-facing site and are working quickly to fix it.”

Owner-Occupied classification is constantly changing as people move, buy, sell, and pass away. Due to the dynamic nature of this classification, there is a continual audit to check that owner occupied classification is being correctly applied. If you see something in our system that seems to be in error, please contact the Director of Equalization so that it can be investigated.

For further information or to review specific property tax records, please contact the Director of Equalization office at 605-745-5136 or visit the official website at https://fallriver.southdakotadirectors.com/.

Courthouse Closed – Martin Luther King, Jr. Day

The Fall River County Courthouse will be closed Monday, January 19th in observance of Martin Luther King Jr. Day. Regular hours will resume Tuesday, January 20th.

Potential for Emergency Public Safety Power Shutoff this week

Potential Fire Danger this week

Black Hills Energy has announced that there is potential for a PSPS this week. Near-critical fire weather conditions are expected Thursday and Friday, January 15th and 16th, across the Wyoming and South Dakota plains given the strong northwest winds and dry conditions. How to Prepare.

What is a PSPS?

A Public Safety Power Shutoff (PSPS) is a program implemented by Black Hills Energy as a last resort safety measure to prevent wildfires during high-risk weather conditions.

Black Hills Energy Outage Website