The Register of Deeds office is seeking a full-time Administrative Assistant. Included is a nice benefits package including health, vision & dental insurance. Paid time off & SD Retirement. Starting wage is $12.00 – $14.00/hr DOE. See Employment tab for full description.

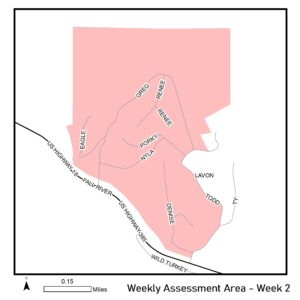

Summer Reassessment – Week 2

Week of July 11th: Assessors will be continuing with properties in the Eagle Valley Subdivision or that are accessed from Eagle Valley Subdivision roads. Due to other meetings the assessors will only have a couple days to work on this area at the end of the week.

Why my property? Fall River County implemented a 7-year rotation after the county-wide reassessment was completed. This ensures that every property is physically visited by an assessor at least once every 7 years. Your neighborhood is one of those scheduled to be visited this year.

What is reassessment? Reassessment is when the assessor comes to your property to check for any changes, whether improvements or deterioration of buildings. They will take new exterior photos and walk around the outside of your buildings. If you are present they may ask you questions about the interior of the building, if you are not present they will leave a doorhanger with contact information so they can converse with you about the property later via phone or email.

What about the COVID-19 pandemic? The assessor’s work does not require personal contact. They will remain outside and observe proper distancing. Our employees will conform to the current recommended practices for safety. Employees will not enter a home unless invited by the owner and will wear face masks while inside. Employees are health screened every morning before beginning work. If you have additional concerns about this issue regarding the assessors visiting your property, please contact our office.

When exactly will you be at my property? We will be posting on our website which streets are being assessed each week, you can check there for updates.

Why don’t you make appointments? The short answer: it takes less time for our assessors to start at one end of the street and do each property than it does to jump from property to property based on appointments. As we are paid by tax dollars, we consider it most important that we perform this job in a time efficient manner. The door-to-door method has proven to be three times more efficient than making appointments.

Who is coming? Our assessors will have county identification badges and will be driving a county vehicle. If you are suspicious that someone is falsely claiming to be an assessor, please call our office at 605-745-5136 or Fall River County Dispatch at 605-745-5155.

See Summer Reassessment page for maps of Summer 2022 reassessment area.

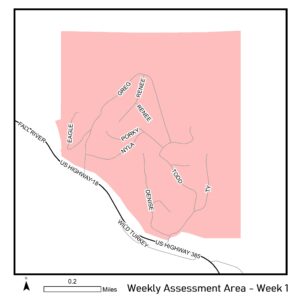

Summer Reassessment – Week 1

Week of July 5th: Assessors have begun their summer reassessment project. They will be beginning with properties in the Eagle Valley Subdivision or that are accessed from Eagle Valley Subdivision roads. This area will most likely not be finished this week.

Why my property? Fall River County implemented a 7-year rotation after the county-wide reassessment was completed. This ensures that every property is physically visited by an assessor at least once every 7 years. Your neighborhood is one of those scheduled to be visited this year.

What is reassessment? Reassessment is when the assessor comes to your property to check for any changes, whether improvements or deterioration of buildings. They will take new exterior photos and walk around the outside of your buildings. If you are present they may ask you questions about the interior of the building, if you are not present they will leave a doorhanger with contact information so they can converse with you about the property later via phone or email.

What about the COVID-19 pandemic? The assessor’s work does not require personal contact. They will remain outside and observe proper distancing. Our employees will conform to the current recommended practices for safety. Employees will not enter a home unless invited by the owner and will wear face masks while inside. Employees are health screened every morning before beginning work. If you have additional concerns about this issue regarding the assessors visiting your property, please contact our office.

When exactly will you be at my property? We will be posting on our website which streets are being assessed each week, you can check there for updates.

Why don’t you make appointments? The short answer: it takes less time for our assessors to start at one end of the street and do each property than it does to jump from property to property based on appointments. As we are paid by tax dollars, we consider it most important that we perform this job in a time efficient manner. The door-to-door method has proven to be three times more efficient than making appointments.

Who is coming? Our assessors will have county identification badges and will be driving a county vehicle. If you are suspicious that someone is falsely claiming to be an assessor, please call our office at 605-745-5136 or Fall River County Dispatch at 605-745-5155.

See Summer Reassessment page for maps of Summer 2022 reassessment area.

Change in Partial Complete Policy

FALL RIVER COUNTY, SD – The Director of Equalization in Fall River County had an office policy for many years of only assessing a building once it had reached a stage of 50% complete. It has been brought to our attention that this policy is not in line with South Dakota codified law.

Beginning in 2022 buildings will be assessed for the portion of the building that is complete as of November 1st.

For instance, if a building is 35% complete on November 1st, 2022, it will be assessed at 35% of its complete value on the March 2023 assessment notice and taxed on that amount in January 2024.

As many of our local contractors and the general public have been aware of the 50% policy, we are issuing this press release to notify everyone of the change.

Fireworks: Where and When

The 4th of July is almost here, so where can you shoot Fireworks in Fall River County?

County

In Fall River County outside of city limits fireworks are permitted SOUTH of the Cheyenne River (everything North is in the Black Hills Fire Protection District) AS LONG AS the fire danger for the Prairie is LOW or MODERATE. The discharge of fireworks is permitted from June 27 through July 10, 2022.

Angostura

Game, Fish, and Parks does not allow fireworks on their properties, this includes the Angostura Recreation Area as well as Sheps Canyon Recreation Area.

Hot Springs city limits

July 4th from 9AM – 11Pm Cones, Fountains and Novelty devices permitted as long as the fire danger for the Southern Hills is not VERY HIGH or EXTREME (See the City of Hot Springs Police Department page for Firework regulations)

No consumer fireworks that explode or provide a “report” such as but not limited to firecrackers, aerial mortars, bottle rockets, skyrockets, etc. may be discharged.

Edgemont City limits

Fireworks are permitted when the fire danger for the Prairie is LOW or MODERATE. From July 1st through the 5th, 9AM to 10PM (until midnight on the 4th).

Fireworks are NOT allowed within the Edgemont City Park without prior approval of the Edgemont Common Council. Fireworks are NOT allowed on any property marked as No Trespassing or with signs prohibiting the discharge of fireworks. All fireworks discharge must be cleaned up and properly disposed of within 24 hours.

Oelrichs

Fireworks permitted as long as the fire danger for the Prairie is LOW or MODERATE. The discharge of fireworks is permitted from June 27 through July 5th, 2022.

As a reminder you can be held responsible for any fires started by Fireworks.