See employment tab for full details.

Resolution honoring Ray Palmer

Whereas, the Fall River County Board of Commissioners have designated August 31st through September 7th, 2021, as a week to honor Ray Palmer, Weed and Pest Department employee, who passed away on August 27th, 2021. The Commission requests that in his honor, the American flag at the courthouse be lowered to half-staff; and

Whereas, Ray Palmer began his employment with Fall River County on May 13, 2013. He was very conscientious of the work he performed as he sprayed weeds throughout the county. Ray was always willing to visit with landowners to work with their situations and was very popular among all. He was a volunteer with numerous community activities, including VA services, traffic control for various events and so much more. He represented Fall River County Weed and Pest Department at booths including Spring Fling and the Fair;

Whereas, the Fall River County Board of Commissioners give thanks to the service Ray Palmer rendered unto Fall River County; and

Now, therefore, be it resolved that the Fall River Board of County Commissioners calls upon all citizens of Fall River County to observe the week of August 31st through September 7th, 2021, in recognition of the service of Ray Palmer, who by his devotion to duties, had rendered invaluable service to the County, and we further call upon the citizens of Fall River County to pay respect and offer their deepest sympathy to the family and friends of Ray.

Dated this 31st day of August, 2021.

Nina Steinmetz, Fall River County Joe Falkenburg, Chairman

Weed and Pest Supervisor Fall River County Commission

ATTEST:

Sue Ganje, Auditor

Fall River County

Employment opportunity

The Fall River County Treasure’s Office is hiring. Please see the employment tab for details.

Coroner position available

Open Immediately. Please see the Employment tab for further information.

Ag Soil Adjustment Application Deadline

The deadline for the ag soil adjustment application is almost here. Forms must be filed before September 1st, 2021 for the assessment notice you will receive in March 2022.

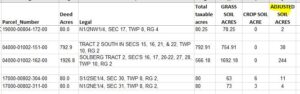

Do I need an application? All Fall River Ag landowners were sent forms early this summer. One of the papers in that mailing was a list of your parcels with the crop, grass, and adjusted acres listed. If you see any acres listed under ‘adjusted’ then we have previously adjusted soils for you. In order to keep those adjustments you must file the State’s new application.

How much money will this save me? It varies from soil type to soil type. Generally the savings is $1-$3 in taxes per acre adjusted. So if you only have 3-5 acres it may not be worth your time to apply. If you have 100 acres that would be $100-$300 in taxes.

You can file the form online. Or call the DOE office for assistance at 605-745-5136 before August 31st.