Update 4/9/2019: Due to the forecasted winter storm the auction has been moved to April 16th, 3pm (same location).

The school land lease auction will be held at the Fall River County Courthouse (3rd floor meeting room) at 906 N River Springs in Hot Springs on April 10, 2019 at 2:30 pm.

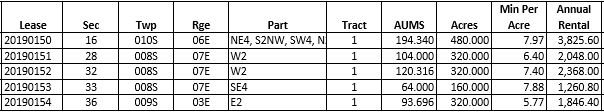

The following lease lands will be auctioned this year:

For information regarding school land leases, terms and conditions, and the full schedule see the SD School & Public Lands website.