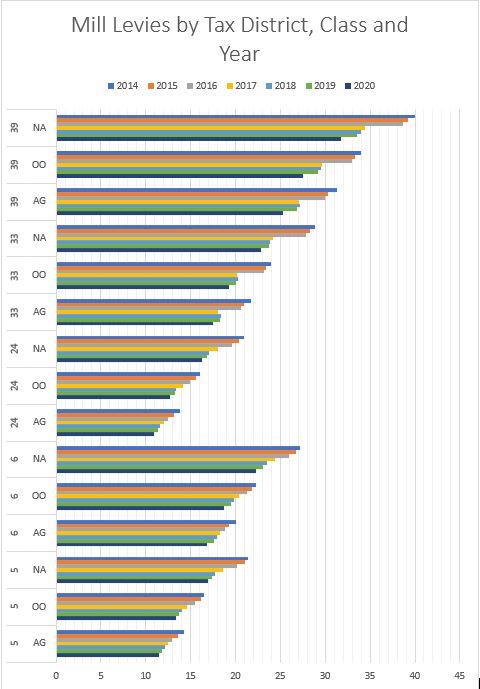

The mill levy sheet was published for the 2019 taxes (payable in 2020). Mill levies across Fall River County decreased for the sixth year in a row. Most areas saw a decrease of 2% to 5%.

Mill levies are expected to decrease after an increase in assessment value.

Follow the link below to see the table of mill levies. You will need to know your tax district to find the correct line of the table. (City of Edgemont – 39, City of Hot Springs – 6, Town of Oelrichs – 33)

Mill Levy Sheet 2019 (taxes payable 2020)

Tax District Map 2020