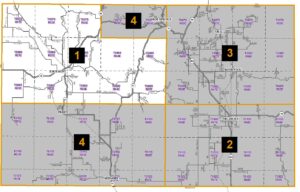

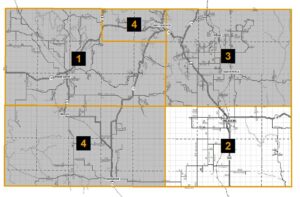

A hearing will be held for road maintenance of county roads located in the southeastern area of Fall River County. (The area marked with a 2 below) The hearing will be held on March 7th, 2024 at 9:30 am at the Fall River County Courthouse.

The exhibits below show the roads being considered for no maintenance. Overview Map of all roads being proposed for no maintenance in this area.

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Jordal Road (County Road 79H) in Township Ten (10) South, Range Six (6) East of the Black Hills Meridian starting at the intersection with Old Highway 79 (County Road 79) then west for a distance of one (1) mile along the section line between Section One (1) and Section Twelve (12) to the end of the road in said Township and Range. [Exhibit A]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Lonewell Road (County Road 79D) in Township Ten (10) South, Range Six (6) East of the Black Hills Meridian starting at the intersection with Old Highway 79 (County Road 79) then west for at distance of one and one half (1 ½) miles along the section line between Section Twelve (12) and Section Thirteen (13) and Section Eleven (11) and Section (14) to the end of the road in said Township and Range. [Exhibit B]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Stagecoach Road in Township Ten (10) South, Range Six (6) East of the Black Hills Meridian starting at the intersection with Lonewell Rd (County Road 79D) then south two (2) miles on the section line between Section Thirteen (13) and Section Fourteen (14) and Section Twenty-Three (23) and Section Twenty-Four (24) to the intersection with Antelope Lane (County Road 4A) in said Township and Range. [Exhibit C]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Antelope Road (County Road 4A) in Township Ten (10) South, Range Six (6) and Township Ten (10) South, Range Seven (7) East of the Black Hills Meridian starting at the intersection with Stagecoach Road then east two (2) miles along the section line between Section Twenty-Four (24) and Section Twenty-Five (25) of Township Ten (10) South, Range Six (6) East and Section Nineteen (19) and Section Thirty (30) of Township Ten (10) South, Range Seven (7) East. [Exhibit D]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Shabram Road (County Road 4B) in Township Ten (10) South, Range Seven (7) East of the Black Hills Meridian starting from the intersection with Hard Scrabble Rd (County Road 4S) then west one (1) mile along the section line between Section Seventeen (17) and Section Twenty (20) ) to the end of the road in said Township and Range. [Exhibit E]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Sagebrush Road (County Road 79J) in Township Ten (10) South, Range Seven (7) East of the Black Hills Meridian starting at the intersection with US Highway 385 then south approximately two and three-fourths (2 ¾) miles along section line between Sections Eleven (11), Twelve (12), Thirteen (13), Fourteen (14), Twenty-Three (23), and Twenty-Four(24) to intersection with Antelope Rd (County Road 4A) in said Township and Range. [Exhibit F]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Milligan Road (County Road 79E) in Township Ten (10) South, Range Eight (8) East of the Black Hills Meridian starting at the intersection with US Highway 385 then west along the section line between Section Thirteen (13) and Section Twenty-four (24) and Section Fourteen (14) and Section Twenty-three (23) for a distance of one and one half (1 ½) miles to the end of the road in said Township and Range. [Exhibit G]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Milligan Road (County Road 79E) in Township Ten (10) South, Range Eight (8) East of the Black Hills Meridian starting at the intersection with South Butte Road (County Road 2K) then east one half (1/2) mile on the section line between Section Seventeen (17) and Section Twenty (20) to the end of the road in said Township and Range. [Exhibit H]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Limestone Road (County Road 2K) in Township Ten (10) South, Range Eight (8) East of the Black Hills Meridian starting at the intersection with South Butte Road (County Road 2K) then east one half (1/2) mile on the section line between Section Twenty (20) and Section Twenty-nine (29) to the end of the road in said Township and Range. [Exhibit I]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of South Butte Road (County Road 2K) in Township Ten (10) South, Range Eight (8) East of the Black Hills Meridian starting at the intersection with Limestone Road the south one (1) mile along the section line between Section Twenty-nine (29) and Section Thirty (30) to the end of the road in said Township and Range. [Exhibit J]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of South Beef Creek Road (County Road 4D) in Township Eleven (11) South, Range Seven (7) East of the Black Hills Meridian starting at the intersection with Hard Scrabble Road (County Road 4S) then west along the section line between Section Eight (8) and Section Seventeen (17) for a distance of one mile to the end of the road in said Township and Range. [Exhibit K]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Wilcox Road (County Road 385D) in Township Eleven (11) South, Range Eight (8) East of the Black Hills Meridian starting at a point one quarter (1/4) mile east of the intersection with US Highway 385 then east about one and one quarter (1 1/4 ) mile east along the section line between Section Seven (7) and Section Eighteen (18) and Section Eight (8) and Section (17) to the end of the road in said Township and Range. [ Exhibit L]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Unnamed Road (County Road 3A) in Township Eleven (11) South, Range Nine (9) East of the Black Hills Meridian starting at the intersection with Chadron Road (County Road 3S) then meandering northwest through Section Sixteen(16) for a distance of about one (1) mile to the western section line of said Section in said Township and Range. [Exhibit M]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Hill Crest Road (County Road 5H) in Township Eleven (11) South, Range Seven (7) East & Twelve (12) South, Range Seven (7) East of the Black Hills Meridian starting at the intersection with East Ardmore Road (County Road 5) then south along the section line between Section Thirty-one (31) and Section Thirty-two (32) of Township Eleven (11) South and Section Five (5) and Section (6) of Township Twelve (12) South for a distance of approximately one and one quarter (1 ¼) mile to the end of the road in said Township and Range. [Exhibit N]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Harmony Road (County Road 5I) in Township Eleven (11) South, Range Seven (7) East & Twelve (12) South, Range Seven (7) East of the Black Hills Meridian starting at the intersection with East Ardmore Road (County Road 5) then southwest approximately one-tenth (1/10) mile to the section line, then south along the section line between Section Thirty-three (33) and Section Thirty-four (34) of Township Eleven (11) South then meandering southwesterly through Section Four (4) of Township Twelve (12) South to a point near the center of the northwest quarter of the southeast quarter (NW1/4SE1/4) of said section. The total distance of the described road being approximately 2 miles. [Exhibit O]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Unnamed Road in Township Twelve (12) South, Range Six (6) East of the Black Hills Meridian starting at the intersection with Black Banks Road (County Road 20S) then west along the section line between Section Twelve (12) and Section Thirteen (13) for a distance of about one quarter (1/4) mile to the end of the road in said Township and Range. [Exhibit P]

The Board of Commissioners of Fall River County, South Dakota will be considering the designation of Unnamed Road (County Road 385C) in Township Twelve (12) South, Range Seven (7) East of the Black Hills Meridian starting at the intersection with US Highway 385 then west along the section line between Section One (1) and Section Twelve (12) for a distance of approximately eight hundred (800) feet to the end of the road in said Township and Range. [Exhibit Q]

See page for all Road Maintenance Hearings for 2024